MotilalOswal Home Finance Limited

Company Background: Incorporated in 2013, MotialOswal Home Finance (previously Aspire Home Finance Corporation Limited) is a housing finance company is a subsidiary of MotilalOswal Finance Services Limited (MOFSL). The promoter holding is

Company Background: Incorporated in 2013, MotialOswal Home Finance (previously Aspire Home Finance Corporation Limited) is a housing finance company is a subsidiary of MotilalOswal Finance Services Limited (MOFSL). The promoter holding is

MotialOswal Home Finance (MOHFL)provides home loans to individuals and families for construction,purchase, repairs/renovations or extension of their house. MOHFL is present 9 states through a network of 110 branches. These states are namely MAHARASHTRA,Gujarat,Madhya Pradesh,Karnataka, Rajasthan,Chhattisgarh,Tamil Nadu,Telangana and Andhra Pradesh.

During FY20, MOHFL has restructured its business and as a result received credit rating upgrade amid challenging environment based on several positive changes undertaken. Crisil has upgraded MOHFL’S ranting to AA- (stable) FROM EARLIER A+ (stable).

The key pillars for strong growth like independent collection and legal organization are now put in place. The company has shifted to in-house developed IT platform called “Loan Origination System” (LOS) and “Loan Management System” (LMS). It has boosted its business verticals namely Sales, Credit, Collection & Operations with 1184 employees (Sales: 381, Collections: 457, Credit: 93 & Ops/corporate: 253). The loan approval is a 4 layered process now. Additionally there is a Dedicated Risk Containment Unit (RCU) in MotilalOswal Home Finance to minimize fraud related to income documents, profile and collateral.MOHFL invested in digital initiatives to reduce operating costs and turnaround time for processing loans thereby improving its overall productivity and performance.

Financial Performance: In FY20 the company sold assets worth of 595 cr to Phoenix ARC for a consideration of 293 cr. This resulted in significantreduction of the GNPA & NNPA ratios to 1.81% and 1.36%respectively which boosted lenders’ confidence. As a result, itreduced the cost of funds for incremental capital raised by the company by 100 bps, thereby bringing its overall cost of funds to 10.16%.

| Metric | Value |

| NIM | 5.30% |

| GNPA | 1.81% |

| NNPA | 1.36% |

| Debt-Equity | 3.4x |

| Cost-to-Income | 41% |

| Capital Adequacy | 47.58% |

MOHFL is focusing more on Self-construction (lower delinquency) loans as compared to new purchases. The company has avoided builder Loans, plot loans and plot + construction loans. Strategically these actions keep the NPAs in check. Now robust collection and rigorous legal is the back-bone of business. The company has also diversified its liability mix with strong Asset Liability Management.

The company disbursed loans worth 190 crores during FY20 with an average loan size of 8.8 lakhs (with a cap of 25 lakhs) and the average tenure being 15 years. Average loan-to-value ratio is a conservative 58% as of FY20.

Please find below a brief financial snapshot performance (amounts are in Rs. INR)

| Particulars | FY19 | FY20 | %chg |

| Interest income | 6,285,769,691 | 5,636,686,057 | -10.3% |

| Net gains on fair value changes | 62,641,190 | 20,197,828 | -67.8% |

| Fees and other Income | 66,276,090 | 73,155,505 | 10.4% |

| Total revenue from operations | 6,414,686,971 | 5,730,039,390 | -10.7% |

| Other income | 69,450,000 | 34,361,570 | -50.5% |

| Total Income | 6,484,136,971 | 5,764,400,960 | -11.1% |

| Finance cost | 4,040,645,741 | 3,432,563,737 | -15.0% |

| Employee benefits expenses | 637,248,930 | 626,577,814 | -1.7% |

| Depreciation and amortization expenses | 44,900,619 | 68,004,053 | 51.5% |

| Impairment on financial instruments | 3,523,166,020 | 766,468,476 | -78.2% |

| Other expenses | 353,737,974 | 261,618,866 | -26.0% |

| Total Expenses | 8,599,699,284 | 5,155,232,946 | -40.1% |

| PBT | -2,115,562,313 | 609,168,014 | |

| Tax (deferred tax) | -746,736,708 | 218,391,279 | |

| PAT | -1,368,825,605 | 390,776,735 | |

| Diluted EPS | -0.25 | 0.06 |

For detailed financial performance please click here.

Future Outlook:

FY21 outlook remain muted amid COVID-19 pandemic outburst with no visibility on how long it will continue. As per ICRA estimate loan book growthfor the housing finance sector would be 6-8% for FY21. Profitability for the sector will obviously be impacted due to shrinking of spreads and elevated credit costs.

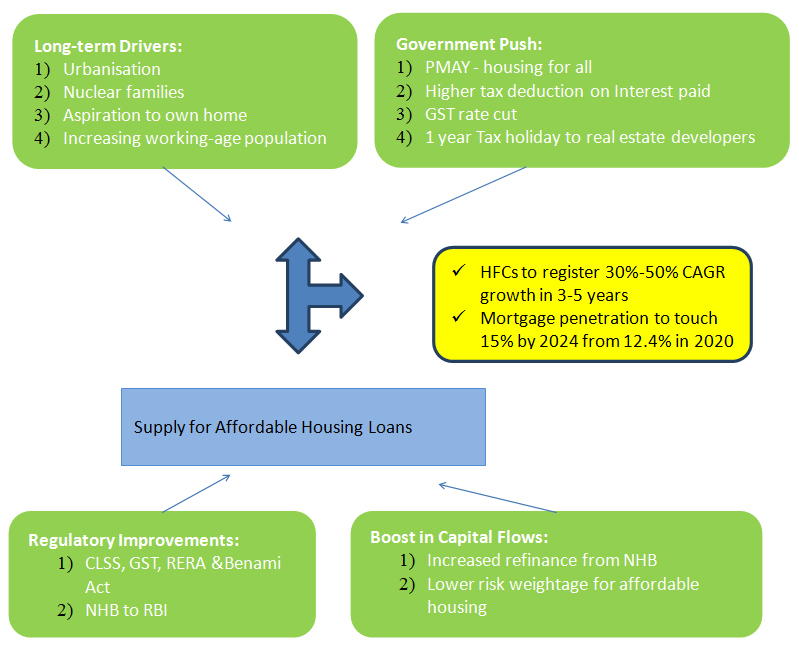

From a longer term perspective, at a macro level, the prospects of housing finance industry for the affordable section are bright. As per CRISIL report, India’s Mortgage Penetration Expected to Touch 15% by 2024 from currently ~12.4%. HFCs operating in affordable housing space (sub Rs. 25 lakh loan category) have been growing well and are expected to register CAGR of 30-50% over the next 3-5 year period thereby outpacing the industry.

Below are few key pointers for the same.

On the structural front, urbanization, migration of population to cities, nuclearisation of families, rising working age population, and the emotions associated with owning a home will continue to aid the growth in the housing finance sector. As per ICRA, over the medium and long term, the industry is projected to grow by 7-8% driven by growth in affordable housing space.

The government’s focus on ‘Housing for All by 2022’ has helped the housing finance industry to report a growth of 17% CAGR over the last five years. PradhanMantriAwasYojana Urban (PMAY) which was launched in 2015 targeted the creation of 50 million houses by 2022.

The Union government in its budget extended the benefit of availing additional deduction of up to Rs1.50 lakh for interest paid on loans for affordable houses by an additional one year till 31 March 2021.

The Central government has further incentivized the affordable housing sector by giving a one-year tax holiday extension to real estate developers in the Union Budget 2020.

The government implemented cut in GST rates in FY19 after the one which took place in FY18. For affordable houses, the rates have dropped down to 1% from 8%.

The Union Budget 2019-2020 announced the transfer of regulatory power on HFCs from NHB to the RBI. This is expected to result in more streamlined regulations and implementation as well as better risk management framework for HFCs.

Since 2013, risk weight for housing loans has been continuously reduced in a progressive manner. Lower risk weight has enabled HFCs and banks to lend more against their capital. Furthermore, in June 2017, the RBI lowered the standard assets provisioning on individual housing loans to 0.25% from 0.4% earlier. NHB raised refinancing target from Rs 240 billion in July 2018 to Rs 300 billion for July 2019. These are progressively increased and are helping lower the cost of funds for the HFCs.